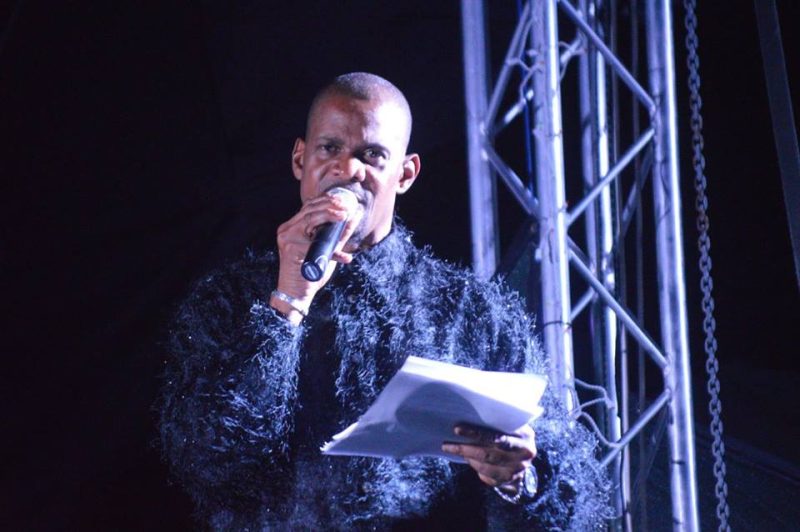

Peter D. A. Queeley, General Manager of Montserrat-based St Patrick’s Cooperative Credit Union called the latest blacklisting of the island “economic terrorism”.

Queeley’s remarks followed a Guardian newspaper article by Juliette Garside which included Montserrat as well as several other Caribbean nations on a list of 21 nations, that the Organisation for Economic Cooperation (OECD) says threatens efforts to combat tax evasion.

“The action by the OECD to include Montserrat and other countries offering Economic Citizenship and Residency by Investment Programmes on a list of high risk countries for tax evasion and now tax avoidance is nothing short of economic terrorism,” Queeley said, adding that it was time the island took a stand.

Other Caribbean nations flagged as offering “golden passport” schemes which sell either residency or citizenship, included Antigua and Barbuda, the Bahamas, Dominica, Grenada, St Lucia, and St Kitts and Nevis. Each runs Citizenship by Investment Programmes, several of which have come under international scrutiny for lax due-diligence procedures among other things. CIP is a growing US$ 3 billion industry which gives nations access to cash from high net-worth clients.

Montserrat has an Economic Residency Programme through which permanent resident status can be obtained after five years of living on the island. Residency can be obtained by meeting one of the following criteria:

- Bank Deposit of ECD 400,000 (US$150,000) – The applicant is required make a term deposit in any commercial bank operating in the jurisdictions.

- Property investment of at least ECD 400,000 (US$150,000) – Another useful route is via the purchase of real estate with a value of at least $150,000 which is situated in Montserrat.

- Government Securities (Bonds) – Via investment in government securities to the value of at least ECD 400,000 (US$150,000).

Permit holders must also meet the residency laws which require Montserrat to be their primary place of residence.

Ursula Barzey, Editor of Caribbean and Co. and an expert on Citizenship by Investment Programmes, said she was “surprised to see Montserrat added to the OECD blacklist as most ultra high net worth individuals seeking to secure a second passport, don’t want to wait five-plus years to finalize citizenship. This is because one of the main reasons for acquiring a second passport is the ability to travel more easily for business and pleasure. Thus they would be more attracted to those programmes that offer immediate citizenship and a second passport after a thorough application and due diligence process which involves regional and international agencies. As such, it would be imperative for the OECD to give specific details as to why the Montserrat Economic Residency Program overseen by the British government is on the list.”

Hon. Leader of the Opposition Easton Taylor-Farrell commented that “the OECD is bent on keeping emerging economies in economic servitude.”

The report notes that CBI and RBI programmes can have legitimate uses, “including the wish to start a new business in the jurisdiction, greater mobility thanks to visa-free travel, better education and job opportunities for children, or the right to live in a country with political stability. At the same time, information released in the market place and obtained through the OECD’s Common Reporting Standard (CRS) public disclosure facility, highlights the abuse of CBI/RBI schemes to circumvent reporting under the CRS.”

It said “CBI/RBI schemes can be misused to undermine the CRS due diligence procedures. This may lead to inaccurate or incomplete reporting under the CRS, in particular when not all jurisdictions of tax residence are disclosed to the Financial Institution. Such a scenario could arise where an individual does not actually or not only reside in the CBI/RBI jurisdiction, but claims to be resident for tax purposes only in such jurisdiction and provides his Financial Institution with supporting documentation issued under the CBI/RBI scheme, for example a certificate of residence, ID card or passport.”

The organisation said the growing US$ 3billion citizenship by investment industry can be used by criminals for tax evasion and other nefarious deeds.

After analysing residence and citizenship schemes operated by 100 countries, the OECD says it is naming those jurisdictions that attract investors by offering low personal tax rates on income from foreign financial assets, while also not requiring an individual to spend a significant amount of time in the country.

Other names on the list are Bahrain, Colombia, Cyprus, Malaysia, Malta, Mauritius, Monaco, Panama, Qatar, Seychelles, Turks and Caicos Islands, United Arab Emirates and Vanuatu.

In 2015, the island was black listed by the European Union as a tax haven despite it being compliant with all of the transparency regulations.

Sources:

http://agc.gov.ms/wp-content/uploads/2011/10/13.01-Immigration-Act.pdf