The Monetary Council of the Eastern Caribbean Central Bank has approved the suspension of development of DCash 2.0, opting instead to prioritise the establishment of a Fast Payment System and participation in the CARICOM Payments and Settlement System pilot.

The decision was taken at the 112th Meeting of the Monetary Council on 13 February 2026.

Background to DCash

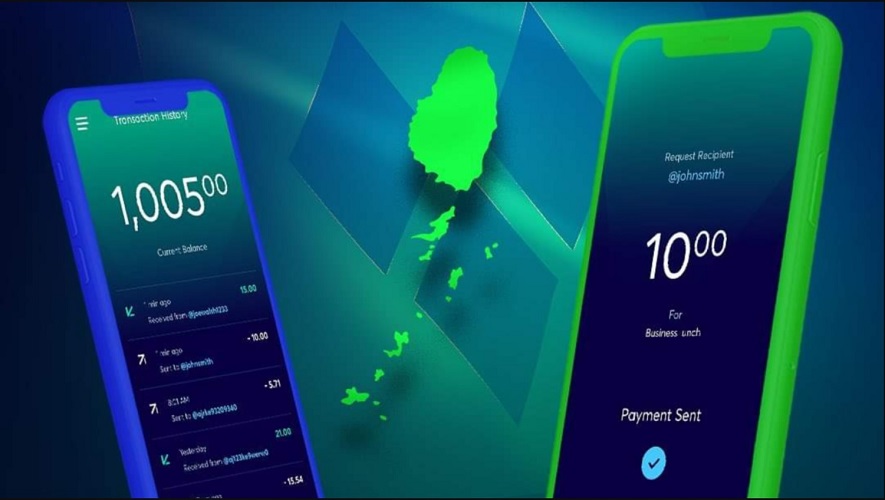

The ECCB launched its digital currency initiative in March 2019 under the DXCDCaribe banner, introducing a securely minted digital version of the EC dollar known as DCash.

The DCash Pilot officially commenced in March 2021 and was conducted across all eight Eastern Caribbean Currency Union member countries. The pilot tested the creation, distribution, management and use of a retail Central Bank Digital Currency for person-to-person, person-to-business and business-to-business transactions. The pilot concluded in January 2024.

DCash was issued by the ECCB and distributed through licensed banks and non-bank financial institutions. It functioned as the digital equivalent of the EC dollar and was accessible through smart devices.

Following the pilot, the ECCB outlined plans for DCash 2.0, which was envisioned as a secure, scalable retail CBDC platform capable of supporting P2P, P2B, B2B, government-to-person and person-to-government payments, with instant settlement and interoperability. In December 2023, the ECCB issued a Request for Information to technology vendors in preparation for the next phase.

Competitive Payments Landscape

The suspension of DCash 2.0 comes amid significant growth in digital payment options across the ECCU. Commercial banks have expanded mobile banking platforms and private digital wallets have increased their presence in the market.

Regional businesses also continue to operate across multiple currencies, including the EC dollar, US dollar and other Caribbean currencies, underscoring the importance of efficient cross-border and multi-currency payment solutions.

By shifting its focus to the Fast Payment System and the CARICOM Payments and Settlement System pilot, the ECCB is positioning its digital payments strategy within a broader regional integration framework.

The ECCB has indicated that the recalibration is intended to support more seamless regional transactions while advancing financial inclusion and modernisation of the payments ecosystem.

Discover more from Discover Montserrat

Subscribe to get the latest posts sent to your email.